January Newsletter

|

2023!!! |

Greetings! Here we are! 2023! We pray everyone had a great Christmas and New Years Day. We all enjoyed family and friends and now we are ready to hit the new year running. Did you make any New Years resolutions? Have you set any goals for yourself for this year? Starting a Devotional The phrases "doing devotions" or "having devotions" may sound foreign or weird. These phrases are simply ways people describe spending time with God by reading the Bible (and other Christian literature) and praying. Why bother to read the Bible and pray? Why is having a regular time with God important? We spend time with God in order to deepen and strengthen our relationship with the One who created us and yearns to be with us. But because we are all different and because each of us has a unique relationship with God, no one devotional pattern will work for everyone. And no one way works for anyone all of the time. Experiment until you find the time of day, content, and length of time spent that helps you feel connected with God. BASIC PATTERN

You may want to record your thoughts and feelings in a notebook or journal, to help you remember what God has been saying to you. Many people find it helpful to write about concerns and to write a prayer as a way to end their devotional time. If you are just beginning to take time for reading the Bible and praying, plan to spend about ten minutes. As you become more comfortable with the process, you may find yourself spending a longer time

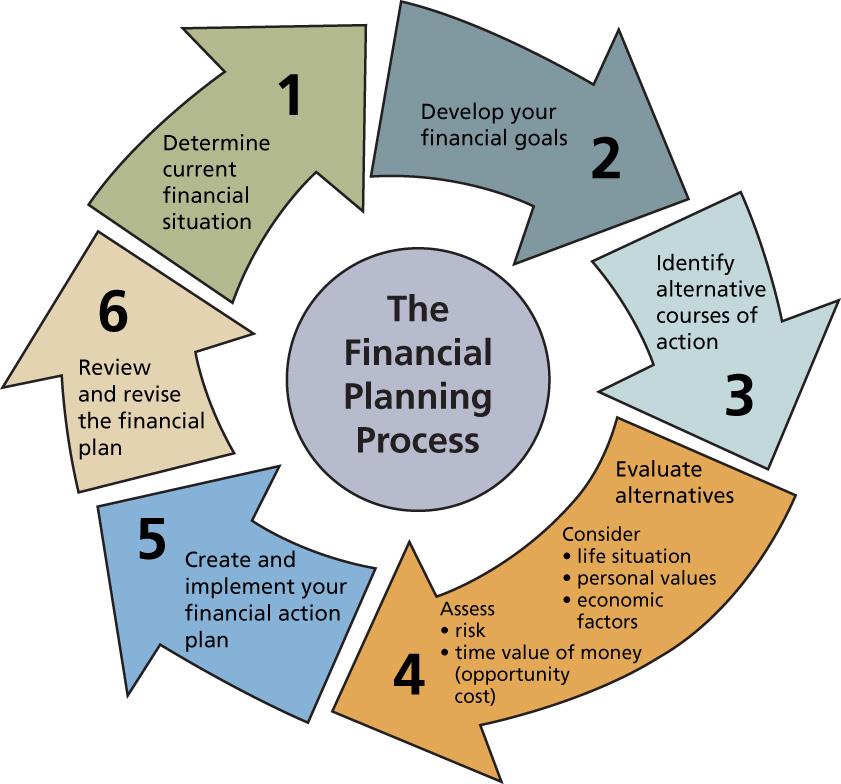

5 Financial New Year's Resolutions to Put on Your List for 2023 Many people like to use the beginning of a new year as an opportunity to pledge to do better in some regard. That might mean getting more sleep, eating healthier food, and exercising more than once every six weeks. It could also mean tackling money moves you may have neglected in the past. If you're in the process of mapping out your New Year's resolutions for 2023, it pays to focus on personal finance matters just as much as health-related ones. And here are five key items to put on your to-do list. 1. Build a three-month emergency fund There's no way to know if 2023 will be the year you're laid off at work or your once-trusty car decides it no longer wants to run. That's why you need a safety net -- money you can tap when you're stuck in a financial jam. And so at a minimum, you should aim to build yourself an emergency fund with enough money to cover at least three months of essential bills. That way, you'll be able to dip into your savings account rather than resort to debt if life doesn't go your way. 2. Start funding a retirement plan You'll need savings to help pay the bills in retirement, and your IRA account or 401(k) isn't going to magically fund itself. So make this the year you carve out money each month for your long-term savings. The sooner you contribute funds to a retirement plan, the sooner you can start investing your money so it's able to grow into a larger sum over time. 3. Follow a budget You might think budgeting is boring or lame. But it's an essential part of managing your money. The good news, though, is that you don't have to actively work on your budget every day. You can sign up for a budgeting app that links to your checking account and credit cards so you can track your spending without having to constantly crunch numbers. 4. Check your credit report once every quarter Consumer credit reports will be free on a weekly basis in 2023. But generally speaking, you don't have to review yours once every seven days. Rather, a quarterly check-in should suffice. That should give you a snapshot of your financial picture and also help you spot errors or fraud early on. 5. Maintain your home to prevent costly repairs It's easy to skimp on home maintenance when things seem to be working just fine. But if you don't do things like clean out your gutters, have your heating and air conditioning system serviced, and keep your trees nice and trimmed, you might end up with major issues down the line that cost you a lot of money. A much better bet is to tackle maintenance items during the year so you're not hit with unpleasant surprises. Financial resolutions are a good thing to make, and putting yours in writing might help you stay on track. Pledging to do these five things could help you close out 2023 in a financially strong place, so it's worth making the commitment and effort.

8 Times You Should Contact Your Financial AdviserWhether you experience a job change or begin caring for aging parents, your financial adviser can help manage the impact on your financial plan. Hopefully, your financial adviser regularly reaches out to you via emails, videos, articles or phone calls when they have important information to share with you. But when should you contact your adviser? There are many life events that could prompt you to consult them, and I thought we would cover some of the more common reasons for you to reach out. 1. Change in Job Status.If you change jobs, there are several reasons to consult your adviser. Deciding if you should roll over your retirement plan is tops among them. You might also need to review your new company’s benefits package, including insurance (health/life/disability), 401(k) plan, tax withholding, etc. The new job could also entail more or less expenses related to commuting, mileage, etc., which could all affect your financial plan. Losing a job requires planning for health insurance, cash flow, etc. 2. Kids Preparing to Go to College. Ideally, two years before your kids go to college, you should run a mock FAFSA(opens in new tab) to get an idea of where you stand regarding financial aid. Since the FAFSA now looks at your tax return from two years prior, you might want to do some proactive planning to potentially reduce your expected family contribution (EFC), which could help lower the out-of-pocket cost of college.3. Change in Marital Status. A marriage or divorce can obviously have a dramatic effect on your financial plan. Alimony, child support, pension or retirement plan divisions can all add up to a major change in your future circumstances. A marriage, especially a second marriage, requires additional planning, particularly if assets are intended to stay with each of your respective families. 4. Death or Care of a Parent.Estate planning for your aging parents can mean the difference between preserving an inheritance or potentially costing you money. Sadly, I’ve seen many children of aging parents have to postpone their own retirement due to the costs associated with helping parents. Proper planning could help mitigate these costs. 5. Planning to Retire.While the prospect of retirement is certainly appealing, there are many decisions that need to be made in preparation for retirement itself. 6. Birth of a Child.A new baby brings lots of joy but also a lot of required time, and sometimes planning is the last thing on your mind. Things to consider are 529 college savings plans and reviewing your life insurance and your overall estate plan. Important decisions need to be made, such as who would have guardianship of your child if something happened to you. 7. Change in Your Health.A change in health status can require your financial plan to need revisions. Revised life expectancy assumptions or increases in expenses tend to be the most common changes. 8. Major Purchase.Ideally, you should contact your adviser before making a major purchase. Advisers could help decide the most tax-efficient assets to use or if financing is appropriate. Also, what are the effects of this new purchase on the viability of your plan? How to Find a Financial Advisor You Can TrustFinding a financial advisor you can trust really comes down to asking the right questions. Here is a list of seven questions that you could pose to a prospective advisor:

Please make sure you visit the IRS website to see the contribution changes taking place in 2023. Start planning now to take advantage of this plan!https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500 NFS Tax Mailing Schedule Retirement Tax Forms: 5498/1099-R

1099: 1st Mailing

1099: 2nd Mailing

1099: Preliminary Tax Statement

1099: 3rd Mailing

1099: 4th Mailing

We are looking forward to a great year! Please don't hesitate to let us know if there is something we can help you with! Many Blessings! |

|

|

|

|